Statutory accounts also known as annual accounts are a set of financial reports prepared at the end of each financial year. They are created by an Act of Parliament.

3

Malaysia Taxation Junior Diary Non Income Producing Dormant Inactive

Hasil Gov My

Statutory corporate income tax rate.

What is statutory income. Everything You Need to Know. Gazette of Positions required to file Statutory Declarations. Specific statutory exceptions can be found in the penalty-related Internal Revenue Code IRC sections.

Of course there are certain types of income within this list that does not have to be included in your income for tax purposes in other words income that is exempted from tax. Statutory Declaration of Assets Liabilities and Income. Proponents of raising the corporate tax rate argue that corporations should pay their fair share of taxes and that those taxes will keep companies in.

Speed-up your statutory accounts with automatic financial reports in Debitoor. If you received incorrect written advice from the IRS you may qualify for a statutory exception. The statutory tax rate is expressed as a percentage and will always be higher than the effective tax rate.

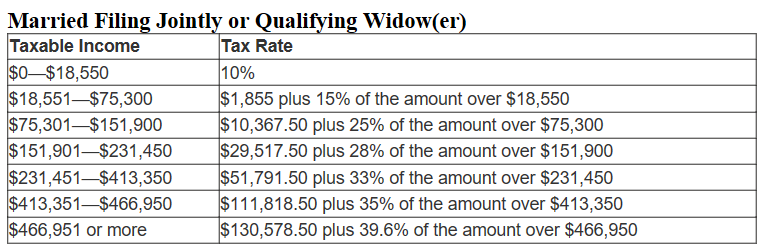

Wages salaries and some work allowances such as overtime bonuses shift allowances and penalty rates. A statutory tax rate is the legally imposed rate. Overall statutory tax rates on dividend income.

Statutory Bodies in India. To be considered a trade or business an activity does not necessarily have to be profitable and you do not have to work at it. Reserves are often used to purchase fixed assets.

Asset-based income tax regime has the meaning given by section 830- 105. Keep track of your company income with Debitoor invoicing software. The statutory employee must also pay their own federal and state income taxes.

Asset entity has the meaning given by section 12-436 in Schedule 1 to the Taxation Administration Act 1953. It also includes unemployment compensation taxable social security benefits pensions annuities cancellation of debt and distributions of unearned income from a trust. Similarly income tax law also mandates an audit called Tax Audit.

Todays rate is set at 21 for all companies. Asset included in the total assets of a company that is a foreign resident has the meaning given by. Try Debitoor free for 7 days.

These are non-constitutional bodies as they do not find any mention in the Constitution. Statutory Declaration Form and Instructions. The statutory tax rate is the rate imposed by law on taxable income that falls within a given tax bracket.

These income types are also known as statutory income. In the UK all private limited companies are required to prepare statutory accounts. Tax legislation may provide an exception to a penalty.

Income from property importation of hydrocarbon oil and gas retail. Overall statutory tax rates on dividend income. Employee social security contribution rates.

Targeted statutory corporate income tax rate. If gross income exceeded JOD 1 million then the taxpayer is required to remit two advance payments on the accrued income tax using certain rates applied for each tax period. Assessment day for an income year of a life insurance company has the meaning given by section 219- 45.

The creation of the federal corporate income tax occurred in 1909 when the uniform rate was 1 for all business income above 5000. Sample Statutory Declaration Form. Statutory employees who must pay income taxes and their share of FICA taxes individually may need to make quarterly estimated tax payments during the year to avoid penalties for underpayment of taxes.

These income types are also known as non-statutory income. 3 A self-employed persons weekly income or loss from self-employment at the time of the accident is the amount that would be 152 of the amount of the persons income or loss from the business for the last completed taxation year as determined in accordance with Part I of the Income Tax Act Canada. General Motors ultimately reported a total 1897 billion income tax benefit that year though the hypothetical income tax provision at the 35 federal statutory rate equaled a 1933 billion expense equating to an ETR of negative 329.

Do you know what are statutory bodies. An income tax could have multiple statutory rates for different income levels where a sales tax may have a flat statutory rate. Request for Status of Declarations Filed.

In Kenya the government manages the PAYE tax through the Kenya Revenue Authority KRA which collects the statutory contributions from the employer before salary and wages are paid to the employee. Targeted statutory corporate income tax rate. Sub-central corporate income tax rates.

Banking custody services insurance certain fund administration businesses regulated investment management services to individual clients operating an investment exchange compliance and other related activities provided to regulated financial services businesses and operating an aircraft registry. Sub-central corporate income tax rates. Public Sensitization about Statutory Declarations.

If the taxpayer is required to remit two advance payments on the accrued income tax then the first advance payment is due within a period not exceeding 30 days from the last day of the first half of that income tax period. Other income such as superannuation compensation overseas pension interest from savings and maintenance. Statutory income from employment refers to not only your monthly salary but also any commission bonus allowances perquisites benefits-in-kind and even accommodation.

The effective tax rate is the percentage of income actually paid by an individual or a company after taking into account tax breaks including loopholes deductions exemptions credits. Employer social security contribution rates. They are also important bodies due to their function.

Since then the rate has increased to as high as 528 in 1969. If workers are independent contractors under the common law rules such workers may nevertheless be treated as employees by statute statutory employees for certain employment tax purposes if they fall within any one of the following four categories and meet the three conditions described under Social Security and Medicare. Self-employment income is earned from carrying on a trade or business as a sole proprietor an independent contractor or some form of partnership.

If you feel you were assessed a penalty as. Non-statutory stock options is a benefit that can have a positive impact on your employees overall income without the company bearing any additional expense. Unearned income includes investment-type income such as taxable interest ordinary dividends and capital gain distributions.

Learn what qualifies a worker as a statutory employee. Pay As You Earn PAYE is the mandatory tax levied on all employees income. Employee social security contribution rates.

Non-Statutory Stock Options. What is a tax audit. Statutory employees are granted a greater tax deduction for their business expenses than other employees because Schedule C expenses are not.

They are called statutory since statutes are laws made by the Parliament or the legislature. There are various kinds of audits being conducted under different laws such as company audit statutory audit conducted under company law provisions cost audit stock audit etc. Or to fund expansions bonuses and dividend repayments.

Welcome To Keppel Land Report To Shareholders 2006

Income Tax Partb Statutory Income Financetwitter

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Monthly Tax Deduction 2 Social Security Organization 3 Employee Provident Plan Skachat Besplatno I Bez Registracii

Definition Of The Statutory Tax Rate Higher Rock Education

Lifecos Overcame Premium Pressure To Post Strong Q3 Statutory Profitability S P Global Market Intelligence

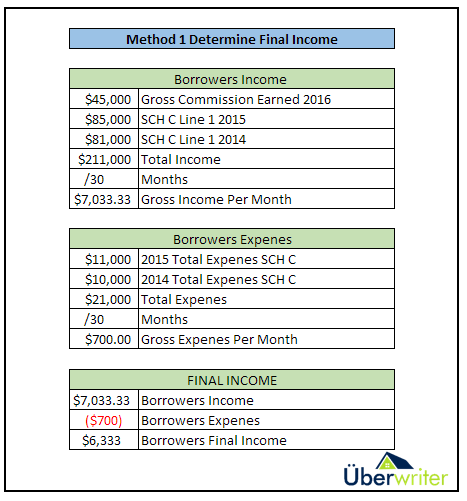

Example Method 1 Income Graphic Blueprint

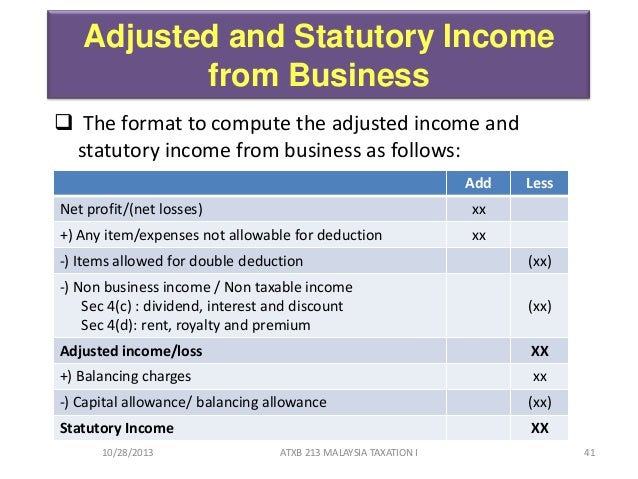

Chapter 6 Business Income Students

Personal Income Tax E Filing For First Timers In Malaysia Mypf My