Bollinger Bands can add that extra bit of firepower to your analysis by assessing the potential strength of these formations. Finally Heineken Malaysia has penetrated its lower daily Bollinger band 2235.

Bollinger Bands Trading Strategy How To Trade It Like A Pro Youtube

Using Bollinger Bands For Swing Trading Greedy Goblin Trader

Trading With Bollinger Band Reversal Patterns

Price patterns appear when traders are buying and selling at certain levels.

Bollinger band patterns. Browse our library of Japanese Candlestick Chart Patterns displayed from strongest to weakest in two columns. AltFINS automatically identifies 16 commonly used chart patterns across multiple time intervals saving traders a ton of time. In its basic form an M-Top is similar to a Double Top chart pattern.

The MACD is below its signal line and negative. 2 Great Bollinger Band Trading Strategies. These patterns could be applied to various trading strategies and systems as an additional filter for taking trade entries.

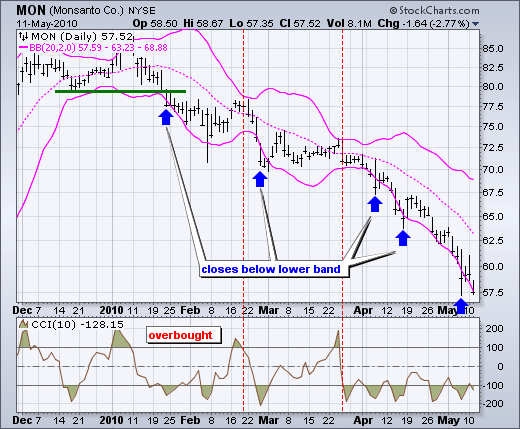

BB is used to determine overbought and oversold levels where a trader will try to sell when the price reaches the top of the band and will execute a buy when the price reaches the bottom of the band. Tests can be made against a specific symbol or you can simulate multi-holding portfolios. This is similar to double top and double bottom patterns respectively that can occur for the price.

However the market rejected it straightaway. Stocks Moving above Upper Bollinger Band with high volume. Introduced by John Bollinger in the 1980s Bollinger Bands BB is perhaps one of the most useful technical analysis indicators.

You can adjust your Bollinger Bands settings to 3 standard deviation or higher to identify even more overboughtoversold levels to trade off. Instead it plots price against changes in direction by plotting a column of Xs as the price rises and a column of Os as the price falls. Backtest screen criteria and trading strategies across a range of dates.

Bollinger Band Trading Strategies. A tag of the lower Bollinger Band is NOT in-and-of-itself a buy signal. Lower Band Volume Sector Other Patterns Chart.

An M-Top occurs when there is a reaction that moves close to or above the upper band. Point and figure PF is a charting technique used in technical analysisPoint and figure charting does not plot price against time as time-based charts do. Select a Stock or Chart.

When we apply 5131 instead of the standard 12269 settings we can achieve a visual representation of the MACD patterns. Tags of the bands are just that tags not signals. Moreover the stock is trading under both its 20 and 50 day moving average respectively at 22947 and 2289.

Many of you have heard of the classic technical analysis patterns such as double tops double bottoms ascending triangles symmetrical triangles head and shoulders top or bottom etc. Bullish Bearish Patterns. The Band Width hovered above the 120-period low.

Dollar BITSTAMPETHUSD Chefrusty Nov 2. BITSTAMPETHUSD Ethereum US. John Bollinger used the M patterns with Bollinger Bands to identify M-Tops.

Bollinger Bands can be used in pattern recognition to defineclarify pure price patterns such as M tops and W bottoms momentum shifts etc. Screener of stock where bollinger band is squeeze from its previous levels on Daily Tick Bollinger band or bandwidth when squeezed or gets narrows sets an excellent breakout platform. Bollinger Bands BB are a widely popular technical analysis instrument created by John Bollinger in the early 1980s.

Bollinger Bands ˈ b ɒ l ɪ nj dʒ ər b æ n d z are a type of statistical chart characterizing the prices and volatility over time of a financial instrument or commodity using a formulaic method propounded by John Bollinger in the 1980s. Price Lower Band Upper Band Lower Band This can be translated as follows. The line in the middle is usually a Simple Moving Average SMA set to a period of 20 days The type of trend line and period can be changed by the trader.

Financial traders employ these charts as a methodical tool to inform trading decisions control automated trading systems or as a component of. These Bollinger Bands scans can help you find stocks which are exhibiting certain volatility characteristics andor patterns. This bearish breakout followed the contraction.

Play with the chart. While it was not a technical Bollinger Band Squeeze signal you can still interpret it as a volatility contraction. Ideally a price breakout above a resistance or below support line is accompanied by an increase in volumeThe subsequent move is likely to be substantial.

The result is used by technical traders to determine. The price on EURUSD is at the lower Bollinger Band that coincides with Support and it formed Bullish Engulfing pattern. It is argued that the best MACD setting for a MACD pattern is 5131.

Bollinger Band - Price Broke Upper Lower Band. Bollinger uses these various W patterns with Bollinger Bands to identify W-Bottoms which form in a downtrends and contain two reaction lows. This is interpreted as breaking resistance with high conviction.

B is calculated as. Strong candlestick patterns are at least 3 times as likely to resolve in the indicated direction. Ethereum US.

Bollinger Bands consist of a band of three lines which are plotted in relation to security prices. A major concept behind the bands is that stocks continually move between phases of high volatility to low volatility and back to high. At extreme lows a failure of RSI to reach the lower band triggers a buy signal.

Bollinger bands B translates a portion of the price information in Bollinger bands into one line rather than the multiple bands you see with the standard indicator. The configuration is negative. Giant cup and handle.

Bollinger Band analysis holds that a failure of RSI to touch the upper band on a second try generates a sell signal. In particular Bollinger looks for W-Bottoms where the second low is lower than the first but holds above the lower band. A tag of the upper Bollinger Band is NOT in-and-of-itself a sell signal.

Percent B is intended to show where price is relative to each band. A technical indicator that compares the number of advancing stocks on the Tokyo Stock Exchange to the number that are declining. Trend Analysis Chart Patterns Fundamental Analysis.

Chart patterns often have false breakouts therefore traders can increase their success by confirming breakouts with other indicators RSI MACD etc or even a simple volume trend. Screened stocks comes with detailed Technical fundamental and FnO data along with charts. Click to view chart in actual size.

ETH Highest Daily Close Above top Bollinger Band. Such a move may give new upward direction. A Bollinger Band developed by famous technical trader John Bollinger is plotted two standard deviations away from a simple moving average.

How To Make Money In Olymp Trade Bollinger Bands Is What You Need

Master Bollinger Bands In Just One Class Youtube

Bollinger Bands Indicator How To Use It And Trade In Iq Option

Bollinger Bands The Complete Guide By John Bollinger Ig Sg

Bollinger Bands And Stochastic Trading Strategy Trade It Like A Pro

Trading With Bollinger Band Reversal Patterns

:max_bytes(150000):strip_icc()/dotdash_Final_Using_Bollinger_Bands_to_Gauge_Trends_Oct_2020-01-73f4b5749a6e445585bc2751d6e39d34.jpg)

Using Bollinger Bands To Gauge Trends

Bollinger Bands Chartschool